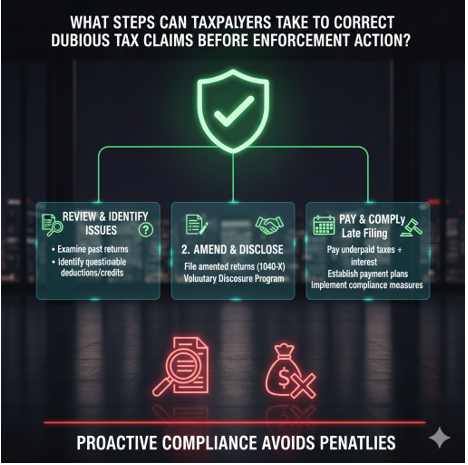

Tax administrations usually give a chance to taxpayers to make corrections to questionable or erroneous claims before the point of enforcement gets increasingly high. Early action also restricts punishment, as well as showing good faith compliance. The major questions that taxpayers ought to consider in dealing with suspected tax claims proactively are as indicated below.

What Qualifies as a Dubious Tax Claim?

The typical characteristics of a dubious tax claim are deductions, credits, losses, or positions on income that are inadequately documented, exaggerated, or based on active interpretations of tax law.

Typical instances would be inflated business costs, the unsubstantiated charitable deductions, or non-conforming loss carry forward, or the dubious offshore reporting. The role of a tax auditor CDTFA is to find those discrepancies, and to protect assets from that one needs an expert who can help the taxpayer.

Why Is Early Self-Correction Better Than Waiting for an Audit?

Prevention of errors prior to the onset of an audit or investigation would remarkably lower the exposure to penalty and interest. Participation on a voluntary basis indicates cooperation, which may restrain the severity of enforcement and prevent allegations of willful misconduct, which have dire consequences.

How Can Taxpayers Review Past Filings for Errors?

The initial step is a careful examination of previous returns, documentation, and reporting positions. Taxpayers ought to reconcile reported data with bank statements, accounting reports, and third-party documents like W-2s and 1099s in order to determine discrepancies or unsubstantiated assertions.

When Should an Amended Return Be Filed?

Corrected returns are to be filed as soon as the mistakes are discovered and before the IRS makes some attempts to contact. The taxpayers can revision incorrectly claimed credits, misreported income, or overstated deductions in an orderly manner using Form 1040-X or using a business amendment, which is orderly.

Can Voluntary Disclosure Reduce Penalties?

Yes. Disclosure initiatives that are voluntary, as well as amendments made in advance, tend to minimize or even abolish some of the penalties. Although it is generally incurred, the penalty payable on negligence or understatement can be reduced where the taxpayer can prove that it was remedied without delay.

How Should Taxpayers Address Dubious Claims Involving Foreign Income or Assets?

There is a need to pay special attention to foreign income and asset disclosures. Specific programs that correct incorrect offshore reporting errors enable taxpayers to enter into compliance, and minimal exposure to harsh penalties will be experienced as long as they act before the enforcing action commences. Experts who know the work of tax accountant attorneys can help the taxpayers to address such dubious claims.

What Documentation Should Be Prepared Before Making Corrections?

Receipts, invoices, contracts, bank records, and legal or accounting analyses of revised positions should be collected by taxpayers. Excellent documentation enhances credibility and lowers the chances of receiving follow-up queries in the correction process.

Is Professional Guidance Necessary for Correcting Dubious Claims?

Professional guidance is highly advised in a complicated or risky situation. Tax professionals assist in the evaluations of exposure, proper amendments, and communication with tax relevant forward with the taxpayer in a systematic but safeguarding the rights of the taxpayer.

How Do Payment Arrangements Fit Into the Correction Process?

In case corrections lead to further tax owing, taxpayers will be able to improve on payment schemes or other settlement opportunities. This precautionary action on payments will avoid liens, levies, or forced measures of collection.

One of the most effective methods to minimize penalties and secure financial stability over the long-term is to fix dubious tax statements prior to the creation of enforcement.