In today’s fast-changing economy, stretching your money isn’t just smart—it’s necessary. With the cost of living rising and inflation hitting everything from groceries to gadgets, finding practical ways to save is more important than ever. That’s where Budget Hacks CWBiancaMarket becomes your ultimate savings tool.

Whether you’re a parent trying to manage household expenses, a student living on a tight budget, or simply someone who wants to stop overspending, CWBiancaMarket helps you shop smarter and save bigger. This guide reveals powerful, real-world strategies—from stacking coupons and cashback apps to setting up budgeting goals—that can help you keep more money in your pocket and still enjoy the things you love.

What Is CWBiancaMarket and Why Budgeters Love It

CWBiancaMarket is a rising star in the world of online shopping, but it’s more than just a place to buy things—it’s a powerful tool for budget-conscious individuals who want to make smarter, more strategic financial decisions.The platform stands out because it’s designed with savings in mind, offering a wide range of products including groceries, electronics, fashion, home essentials, beauty products, and seasonal items—all at competitive prices. What makes CWBiancaMarket unique is its built-in savings infrastructure: it provides loyalty points, exclusive coupons, digital promotions, and budgeting tools that actively help shoppers stay within their means.

Unlike large online retailers such as Amazon or Walmart, which primarily focus on delivering goods, CWBiancaMarket empowers users to shop with intention by layering on savings mechanisms that make each transaction a step closer to financial well-being. It appeals to students managing tuition costs, families controlling household budgets, and anyone who is tired of letting money slip through their fingers.

Setting SMART Financial Goals Using CWBiancaMarket

Effective budgeting begins with a clear vision, and that’s where SMART goal setting comes into play—Specific, Measurable, Achievable, Relevant, and Time-bound objectives. CWBiancaMarket makes it easy for users to apply this framework to their shopping and savings strategy.

For instance, instead of vaguely saying, “I want to save more money,” a user might set a SMART goal such as, “Save $1000 over five months for holiday gifts.” The platform provides features that help break down that goal into manageable monthly targets—$200 per month, for example—and enables users to set spending limits on non-essential categories, track their progress with visual tools, and receive reminders when they’re getting off course.

With built-in analytics, shoppers can look at their spending habits over time and adjust accordingly. CWBiancaMarket’s goal-setting tools not only promote accountability but also turn budgeting into a motivating and achievable process, allowing users to treat their finances like a game they can win.

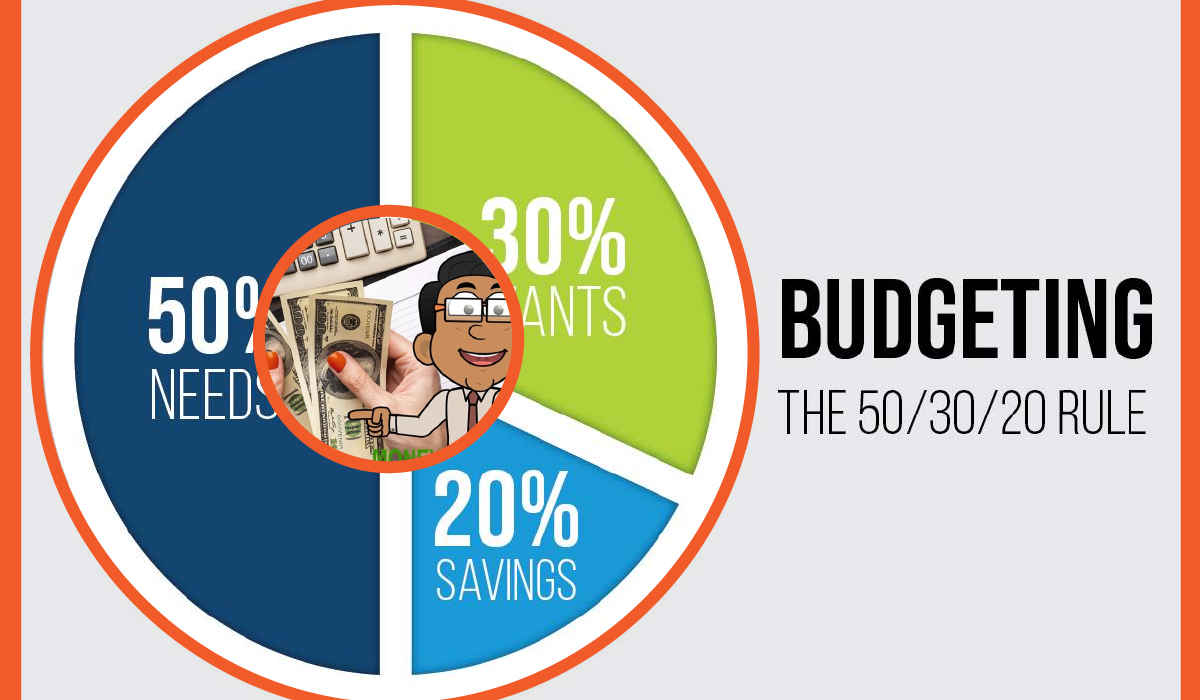

Applying the 50/30/20 Rule with CWBiancaMarket Purchases

One of the foundational budgeting principles that CWBiancaMarket supports is the 50/30/20 rule, which divides monthly income into three categories: 50% for needs, 30% for wants, and 20% for savings or debt repayment. CWBiancaMarket makes this rule extremely practical by offering cost-effective solutions for each category.

For needs, like groceries and household supplies, the platform frequently hosts promotions that reduce overall costs by 10–30%, helping shoppers stretch their essentials budget. For wants, like fashion or tech gadgets, CWBiancaMarket offers rotating seasonal sales and flash deals that let users enjoy luxuries without guilt.

And for the 20% savings portion, every dollar not spent—thanks to loyalty points, cashback apps, or deal stacking—can be funneled into a savings account or used to reduce credit card debt. When you shop on CWBiancaMarket with the 50/30/20 rule in mind, every purchase becomes intentional, and you get the benefit of tracking both savings and spending in real-time through their app’s analytics tools.

Mastering Coupon Stacking and Cashback Strategies

CWBiancaMarket allows users to engage in one of the most powerful budget hacks available—coupon stacking. This strategy involves layering different types of discounts on a single purchase to maximize savings. Start with manufacturer coupons, which are often listed on the product page or available through email subscriptions.

Then apply CWBiancaMarket’s own digital coupons, which rotate weekly and often include category-specific discounts. Next, use your loyalty rewards points to further bring down the total cost. And finally, before you check out, activate a cashback app like Rakuten, Honey, or Ibotta to earn additional savings—usually between 2% and 10% of your purchase.

These steps, when combined correctly, can slash the total cost of a single shopping trip by up to 50%. CWBiancaMarket is designed to support this practice, encouraging users to be strategic, time their purchases, and create a consistent savings habit that becomes second nature over time.

Unlocking the Cart-Abandonment Hack for Extra Discounts

Many users don’t realize that simply leaving items in their cart can trigger additional discounts from retailers—and CWBiancaMarket is no exception. This clever and ethical hack, known as cart-abandonment discounting, works when you add items to your cart and wait 24 to 48 hours without checking out.

Often, the platform will send you an email with a “nudge”—a 5% to 15% coupon to complete your purchase. This tactic is best used for non-urgent items that you’re seriously considering, and when paired with existing promotions, loyalty points, and cashback rewards, it becomes a powerful savings multiplier.

This strategy reflects the growing shift in e-commerce from passive shopping to active negotiation, where the buyer has more leverage than ever before. Budget-conscious users can make the most of this behavior by planning purchases in advance and using timing to their advantage.

More From Info: www Free Worlderorg: The Revolutionary Hub For Sharing And Digital Freedom

Smart Grocery Shopping and Meal Planning for Maximum Value

Grocery expenses are a common budget pitfall, but CWBiancaMarket’s features help transform this challenge into a savings opportunity. The key lies in strategic meal planning, which begins with checking the weekly deals section to see which food items are on sale.Instead of creating a meal plan and then shopping for the ingredients, reverse the process: let the sales determine the meals.

If ground beef, tortillas, and tomatoes are discounted, plan tacos and chili for the week. This approach minimizes costs while also encouraging variety. CWBiancaMarket also supports bulk buying for non-perishable essentials like rice, pasta, beans, and canned vegetables. With proper storage (vacuum sealing, airtight containers), these items can last months and reduce the number of shopping trips you need.

For additional savings, try the “pantry challenge,” where you commit to preparing meals using only what’s already in your pantry or freezer. This eliminates waste and reinforces mindful consumption—key components of effective budgeting.

Controlling Discretionary Spending Without Feeling Restricted

Controlling spending on non-essentials is a challenge for many budgeters, but CWBiancaMarket provides smart tools to make it easier. By categorizing purchases in-app, users can distinguish between needs and wants in real-time. More importantly, CWBiancaMarket allows users to set caps on discretionary categories like fashion, entertainment, or tech. Once you reach the preset monthly limit, the app alerts you and encourages a pause in spending.

This real-time feedback helps train users to avoid overspending while still enjoying their lives. The key is not to eliminate fun spending altogether but to make it intentional. Instead of impulsively buying a new gadget, users learn to plan for it, find the best deal, and buy it at the right time—often during CWBiancaMarket’s monthly promo cycles. These tools turn budgeting from a limitation into a strategy that supports your long-term goals while still allowing room for joy and indulgence.

Reducing Monthly Bills Through Utility and Subscription Tracking

Monthly recurring bills can silently drain your budget, but CWBiancaMarket helps users take back control by providing access to money-saving home items and built-in tracking tools. Shoppers can purchase energy-efficient appliances, LED lighting, smart thermostats, and insulation kits directly from the platform—products that not only qualify for discounts but also reduce electricity costs over time.

Additionally, CWBiancaMarket’s app allows users to input and monitor subscription services like Netflix, Spotify, or Amazon Prime. The system sends alerts before auto-renewals, encouraging users to evaluate whether the service is still needed.

Canceling just two or three unused subscriptions could save an average household over $300 annually. By managing recurring expenses and investing in cost-reducing home upgrades, CWBiancaMarket users can keep fixed costs down and put more money into savings or debt repayment each month.

Real-World Results: Success Stories and Impact

The true power of budget hacks CWBiancaMarket comes to life when you look at the results real users are achieving. Families report monthly grocery savings of $300–$500 by combining meal planning with loyalty discounts and cashback programs. S

tudents juggling tuition and side jobs have paid off over $3,000 in credit card debt in under a year using strategies like the 50/30/20 rule, coupon stacking, and subscription trimming. One key reason for this success is that CWBiancaMarket encourages small, repeatable actions. Over time, these compound into significant financial improvements.

The consistency in savings helps build confidence and turns budgeting into a lifestyle, not a temporary fix. And by participating in CWBiancaMarket’s user community—where people share tips, deal alerts, and motivational wins—budgeting becomes social, fun, and easier to stick with long term.

Conclusion

CWBiancaMarket isn’t just a place to save a few dollars—it’s a full-spectrum platform that equips users with the tools, tricks, and support they need to take control of their financial lives. Whether you’re looking to build an emergency fund, stretch your paycheck, pay down debt, or simply stop overspending, CWBiancaMarket offers a structured yet flexible ecosystem to make that happen.

From goal setting and deal stacking to meal planning and community support, every part of the experience is designed to help shoppers save more and stress less. The result? Financial freedom doesn’t feel out of reach—it feels achievable, practical, and empowering. Start using these proven budget hacks CWBiancaMarket offers, and you’ll soon see just how much further your money can take you.

FAQs

1. What is CWBiancaMarket and how does it help with budgeting?

CWBiancaMarket is an online marketplace designed to help shoppers save money through smart financial tools, discount stacking, loyalty rewards, and personalized budgeting features. It helps users track expenses, plan purchases, and optimize their shopping habits for maximum savings—making it ideal for individuals, families, students, and anyone aiming to improve their financial well-being.

2. How can I stack discounts effectively on CWBiancaMarket?

To stack discounts like a pro, start by applying manufacturer coupons, then add CWBiancaMarket’s digital coupons or promo codes. Use loyalty points at checkout to lower the remaining balance, and don’t forget to activate a cashback app like Honey or Rakuten. This layered savings strategy can help you cut 30–50% off your total cost.

3. Does CWBiancaMarket offer budgeting tools inside the app?

Yes! CWBiancaMarket features built-in budgeting tools that let you set financial goals, categorize spending, track purchases, receive alerts for over-budget categories, and visualize your progress. These tools make it easier to stay financially disciplined while still enjoying shopping and rewards.

4. Can CWBiancaMarket help reduce grocery and household expenses?

Absolutely. CWBiancaMarket offers weekly grocery deals, seasonal discounts, bulk-buy options, and loyalty perks that make it easier to stick to your food budget. By planning meals around current deals and avoiding impulse purchases, users regularly save hundreds per month on household expenses.

5. What makes CWBiancaMarket different from other e-commerce platforms like Amazon?

CWBiancaMarket is built for budgeters. Unlike Amazon or big-box retailers that focus solely on convenience and variety, CWBiancaMarket prioritizes savings, financial literacy, and goal-driven shopping. It’s ideal for those who want to spend smarter, not just shop faster.